IMPORTANT NOTICE

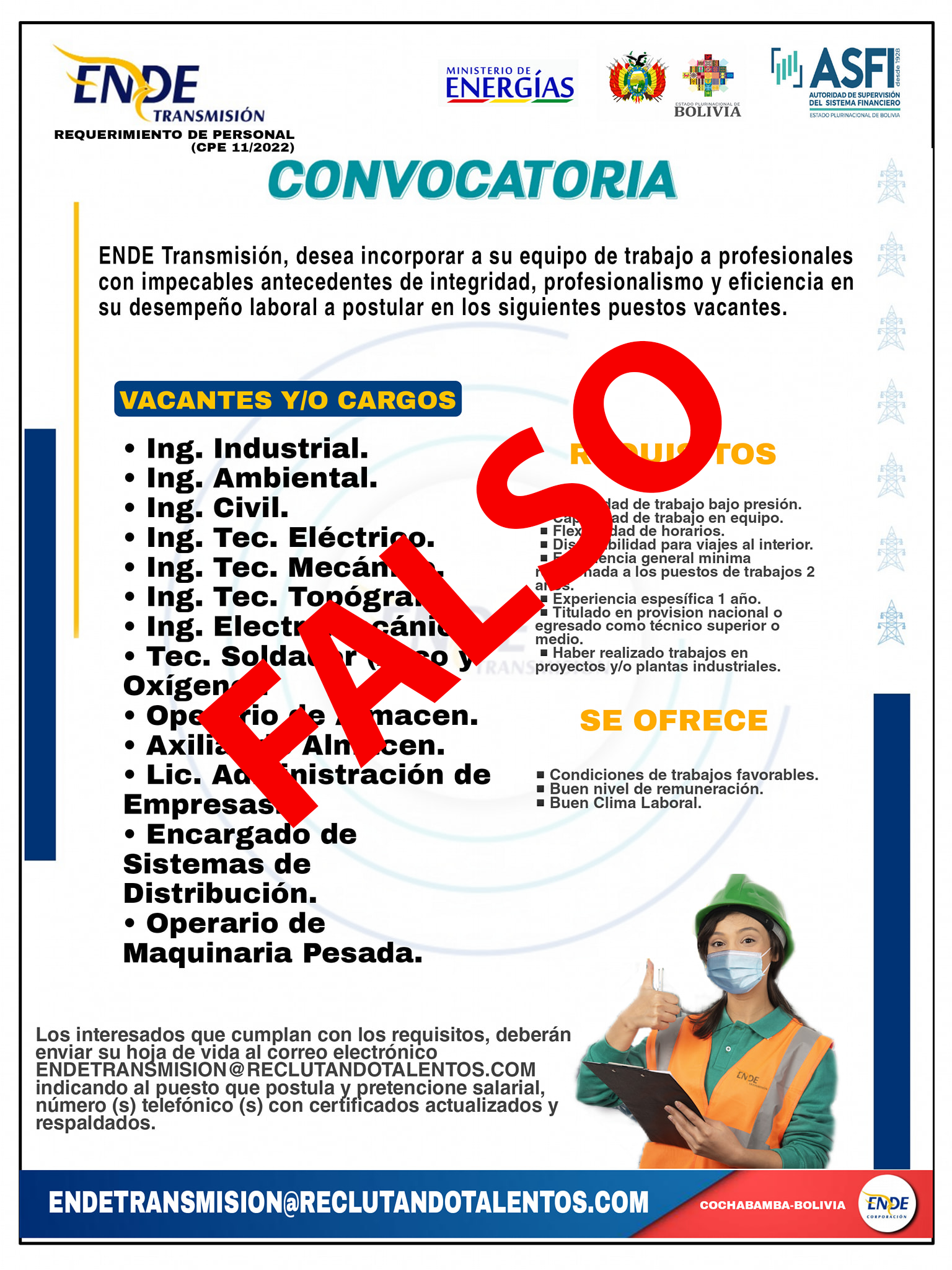

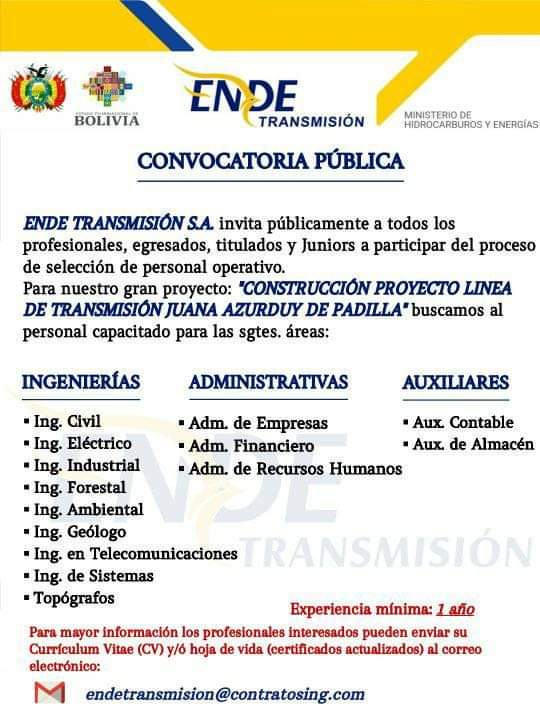

The Company ENDE Transmisión S.A., a subsidiary of ENDE Corporation, informs that people

Unscrupulous and malicious, they are using our logo to try to scam

people through false staff calls.

ENDE Transmission provides services in the country and all publications requiring personnel are made through written press communication media and never requests make a payment for any reason, in order to qualify for the charge.

All our official information can be found on our website www.endetransmision.bo and is replicated on our official Facebook and Twitter pages, never through third parties.

ENDE Transmission provides services in the country and all publications requiring personnel are made through written press communication media and never requests make a payment for any reason, in order to qualify for the charge.

All our official information can be found on our website www.endetransmision.bo and is replicated on our official Facebook and Twitter pages, never through third parties.